Partnering in a digital world

Nationwide’s Partnership Platform is making collaborating with other companies easy

Will Moss knows how important strong partnerships can be.

Moss’s company, HBCU Connect, provides a platform for students and graduates of historically black colleges and universities to network and “connect” with each other and other organizations.

“We founded HBCU Connect to serve a need in our community,” says Moss.

Moss needed to find an insurance company to provide HBCU Connect members and their businesses with insurance products and services digitally.

“HBCU Connect has a community of folks that are either already professionals that are aspirational, that are building a life or building a lifestyle, where they will have things that they need to insure such as cars, homes, and even pets,” explained Moss.

Moss reached out to Nationwide for help. HBCU Connect had a previous connection with the company as an affinity partner. With direction from Moss, Nationwide designed a customized insurance solution tailored to specifically meet the needs of HBCU Connect’s members.

“We are so glad we partnered with Nationwide on this project,” recounts Moss. “Nationwide created this win/win situation for our business.”

The HBCU Connect/Nationwide partnership was made possible due to Nationwide’s emphasis on modernizing its core systems and building digital experiences that allow the company to connect seamlessly with partners.

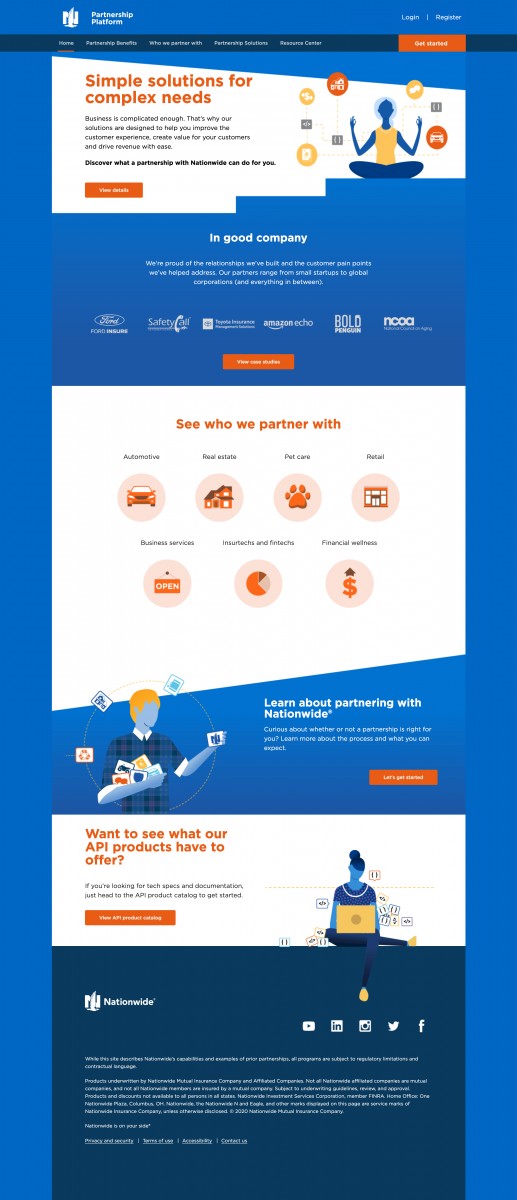

Nationwide® continued to cement its position as an insurance technology leader with the launch of its new Partnership Platform on Nationwide.com. The first-of-its-kind in the insurance industry, Nationwide’s Partnership Platform enables partners and developers to digitally deliver Nationwide’s best-in-class insurance products from across an unmatched portfolio of protection solutions (including auto, home, commercial, pet) on the same digital platform, making the partner experience quick, easy and seamless.

“Consumer and business expectations have evolved, and Nationwide has created industry-leading capabilities to meet those needs digitally, at scale,” says Angie Klett, Nationwide’s Senior Vice-President of Corporate Development. “This new platform allows partners to easily work with us to improve their customer experience, create value for their customers, and drive revenue for their business.”

The Nationwide Partnership Platform serves as an integrated “front door” where companies can quickly enable a partnership with Nationwide, explore our unmatched protection solutions breadth, understand the mutual benefits of partnership, and more. To use Nationwide’s Partnership Platform, potential partners will visit partner.nationwide.com and submit their information. A Nationwide specialist will provide access to the platform, discuss the terms of the relationship, and help tailor digital solutions for their business needs. Partners can rapidly design and deploy an insurance experience leveraging Nationwide’s extensive suite of application programming interfaces (APIs.)

Currently available through the Partnership Platform is a range of pet, auto, home, and commercial insurance solutions with more solutions coming online in the next year.

“To deliver a best-in-class digital partner experience means evolving our platforms with our customers in mind,” says Michael Carrel, Nationwide’s Senior Vice President and Chief Technology Officer for Marketing & Enterprise Growth Solutions. “Nationwide will continue to enhance and extend the Partnership Platform, incorporating feedback from partners and customers to rapidly add new features and expand our capabilities.”

For more information about the Partnership Platform, visit partner.nationwide.com.